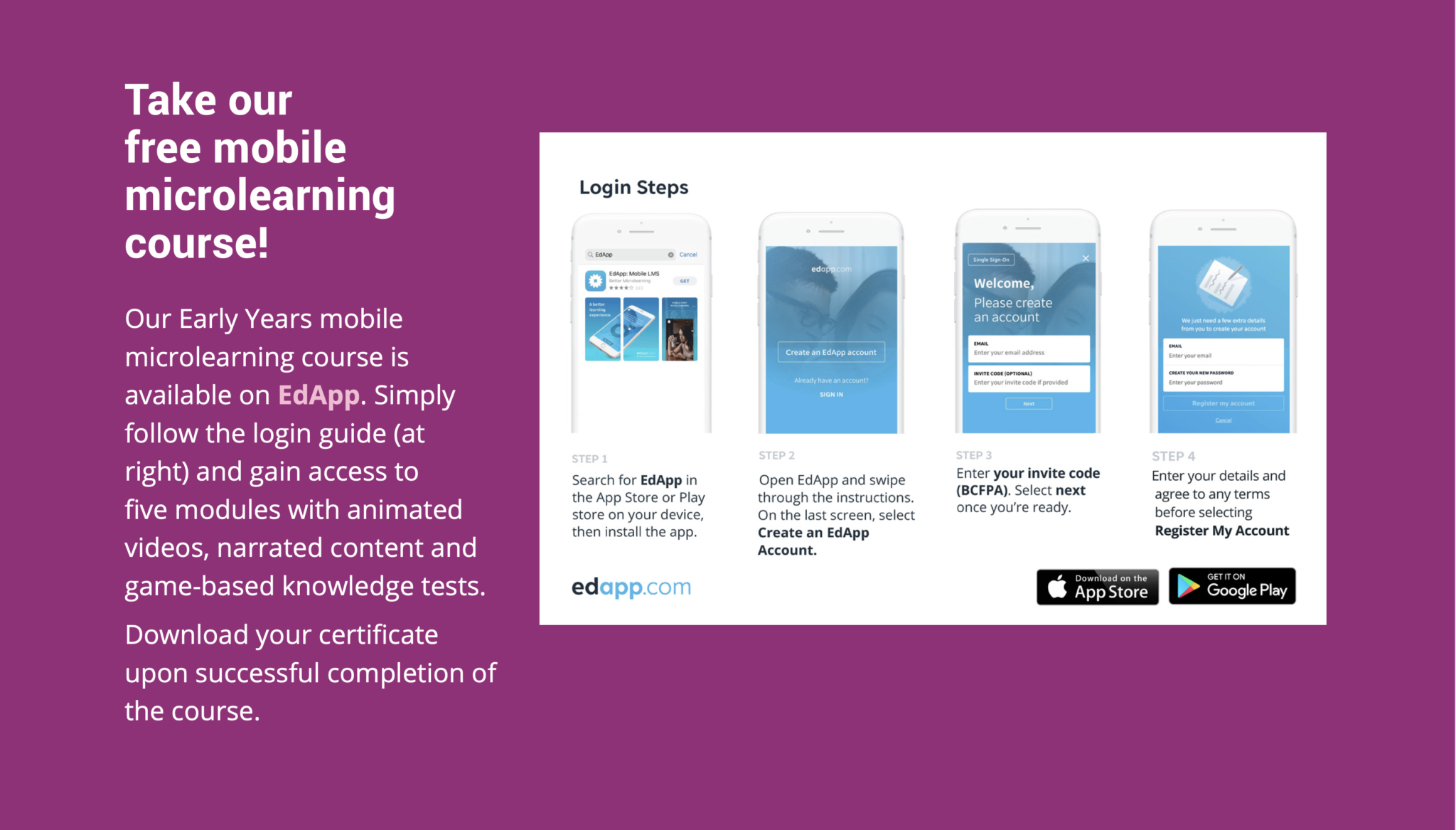

FREE Mobile Microlearning Course through EdApp

Take our free mobile microlearning course through EdApp!

This course was developed as part of our Early Years Resources project whose goal is to strengthen the capacity of foster caregivers to better support the mental, emotional and social development of children under the age of six. It is important that foster parents understand the importance of early childhood development and their pivotal role in supporting children and families during this critical stage. This project is aligned with the Ministry of Children and Family Development’s commitment under the ‘A Pathway to Hope’ Mental Health Strategy whose cornerstone is child and youth mental health.

Phone

Main:

604-544-1110

Toll-Free Foster Parent Line:

1-800-663-9999

Office hours: 8:30 am - 4:00 pm, Monday to Friday

PROVINCIAL CENTRALIZED SCREENING

Foster parents are encouraged to call this number in the event of an EMERGENCY or CRISIS occurring after regular office hours:

1-800-663-9122

REPORT CHILD ABUSE

If you think a child or youth under 19 years of age is being abused or neglected, you have the legal duty to report your concern to a child welfare worker. Phone 1-800-663-9122 at any time of the day or night. Visit the Government of BC website for more info.

address

BCFPA Provincial Office

Suite 208 - 20641 Logan Avenue

Langley, BC V3A 7R3

contact us

Fill out our contact form...

News

Site menu

Subscribe to Our Newsletter

Charitable Registration #

106778079 RR 0001

Our work takes place on the traditional and unceded Coast Salish territories of the Kwantlen, Katzie, Matsqui and Semiahmoo First Nations. BCFPA is committed to reconciliation with all Indigenous communities, and creating a space where we listen, learn and grow together.

© 2021 BC Foster Parents. Site design by Mighty Sparrow Design.